Why Term Deposits are Smart Way to Save for a Better 2026

December 15, 2025

December 15, 2025

Do you have a hard time deciding how to save and grow your money? You might have read online or heard from your peers about various ways of saving and investing your funds but are too afraid to take the risk to do it. Well, introducing term deposit, one of the methods you could take into consideration to save your coins. If you have no knowledge of term deposit, do not fret as we will enlighten you of its procedure, advantages, differences with a regular savings account, as well as some tips for an enhanced experience.

Term deposit is a savings option which allows you to deposit a certain amount in your account, keep it in there for your own desired tenure, and then receive returns according to the allocated profit rate.

This saving method, of course, has its own perks for it. Some of the advantages that makes people choose term deposit are: -

Every term deposit has its own fixed rate which is convenient for you to decide how much returns you would want to receive and customise your plan around it.

The returns you will receive are always guaranteed, allowing you to be confident in keeping your money in the account.

As you will be locking up your money in an account, it could make up for emergency funds in case of unpredictable situations. Although, it is not recommended for you to do an early withdrawal due to a reduced return.

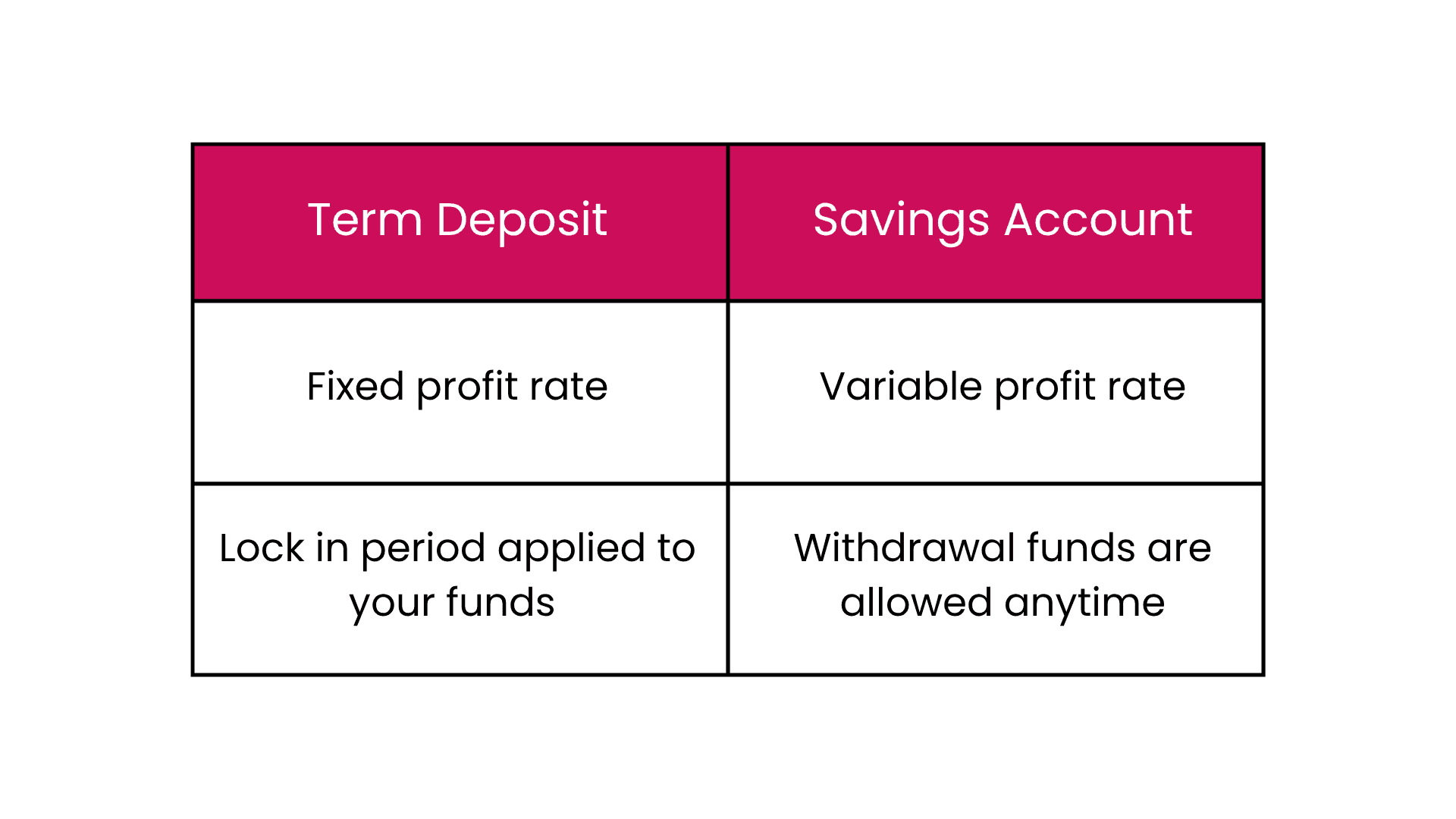

Different people have different styles of savings. It could differ due to financial habits or personal circumstances that push someone to prefer one over the other. To fully understand which type of financial planning suits you better, know the difference between term deposit and savings account.

If you’re a Muslim, you might be searching for term deposit that is Shariah-compliant. Search no more as Be U by Bank Islam provides the very feature that could help you save and grow money with one of the Shariah-compliant term deposits in Malaysia; Be U Term Deposit-i.

Be U Term Deposit-i ensures seamless digital procedure through our Be U application and safe investments protected by PIDM up to RM250,000 each depositor.

For a more detailed and comprehensive explanation of the Be U Term Deposit-i product, visit the webpage for more information here or refer to the Terms & Conditions and the Product Disclosure Sheet for Be U Term Deposit-i.

Maximise your savings by getting into an on-going campaign for term deposit with Be U Term Deposit-i Campaign 2025! Here’s what you need to know about the campaign: -

Want to keep it simple? If you are only interested in term deposit placement, this campaign is the one for you. Be U Term Deposit-i Campaign allows you to enjoy returns with profit rates up to 3.55% for a 6-month tenure period and 3.65% for a 12-month period with a minimum deposit of RM500. Join now as this campaign is only available starting 6th October of 2025 until 31st March of 2026.

Do not miss your chance to enjoy exclusive offers through this campaign as it is only available at a certain duration of time!

When it comes to planning your financial, ask yourself, “Are you flexible when it comes to your finances?” or “Are you tight with your money when it comes to savings?”. Then, do your own research before diving into any kind of financial decision as you know your circumstances better. If term deposit feels right for you, you are welcome to choose this method for the best of your financial well-being.

Although it might seem tempting, try not to hop on the bandwagon when it comes to your finances. Be U and plan accordingly.

Disclaimer: The information presented above is for educational and informational purposes only and it should not be considered as personalized financial planning services. It is not intended as financial, legal, accounting, tax, or any other advisory guidance. Prior to making any financial or other decisions, you must obtain your own independent advice tailored to your individual circumstances.

As part of your decision-making process, you are advised to read the applicable Terms and Conditions (T&C), Product Disclosure Statement (PDS) and Frequently Asked Questions (FAQ) to make informed decisions before subscribing and/or participating in any Be U products.